What Will Be the Possible Changes on MediShield Life in 2021

MediShield Life is a compulsory hospitalisation and surgery insurance scheme for Singapore Citizens and Permanent Residents. It provides lifetime coverage and is managed by the government. As the healthcare environment in Singapore changes, the MediShield Life Council is responsible to adjust the scheme accordingly. Recently on 29 Sep 2020, the MediShield Life Council announced a public consultation to seek views from the public on the preliminary recommendations and suggestions for enhancements to MediShield Life. This article will explain how these potential adjustments will impact us.

Increase the Claim Limits for Certain Benefits

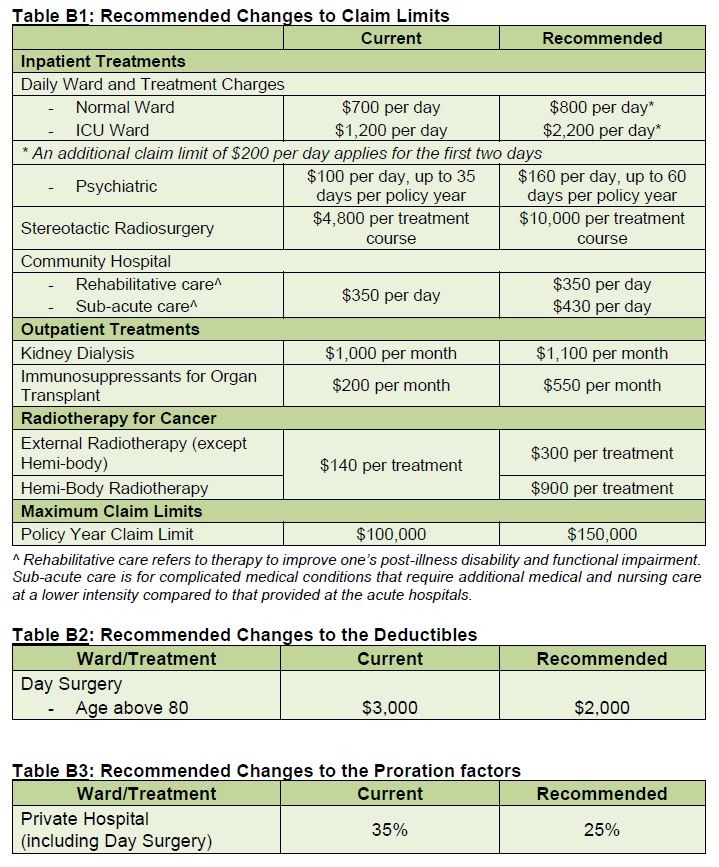

Certain medical expenses have been increasing in recent years. So MediShield Life should offer higher claim limits for them. These medical expenses include: Daily ward and treatment charges (an additional claim limit applies for the first two days), inpatient psychiatric treatment, stereotactic radiosurgery, sub-acute care in community hospitals, kidney dialysis, immunosuppressants for organ transplant, and radiotherapy for cancer.

Raise the Policy Year Claim Limit

Due to the increase in claim limits for the above benefits, the policy year claim limit of MediShield Life should be increased from $100,000 to $150,000 accordingly.

Lower the Deductible for Day Surgeries for Older Patients

The deductible for day surgery patients above 80 years old can be lowered from $3,000 to $2,000. This will ensure that patients are not discouraged from choosing a day surgery over an inpatient stay. In this way the healthcare resources can be allocated more efficiently.

Lower the Pro-ration Factor for Private Hospitals

The pro-ration factor is intended to ensure that patients receive similar MediShield Life payouts regardless of whether they choose subsidised or unsubsidised care. Based on recent bills, a 35% pro-ration factor is still insufficient to bring private hospital bills down to a level comparable to subsidised bills. Lowering the pro-ration factor to 25% will better reflect the actual bill differences and ensure more similar payouts between private hospital and subsidised patients.

Remove Certain Exclusions

The following two exclusions are suggested to be removed: (1) Treatments arising from attempted suicide or intentional self-injury; and (2) Treatments arising from drug addiction, alcoholism or the person being under the influence of drugs or alcohol.

The tables below have summarised the recommended adjustments mentioned above:

Source of Information: Ministry of Health, Singapore

Premium Adjustments

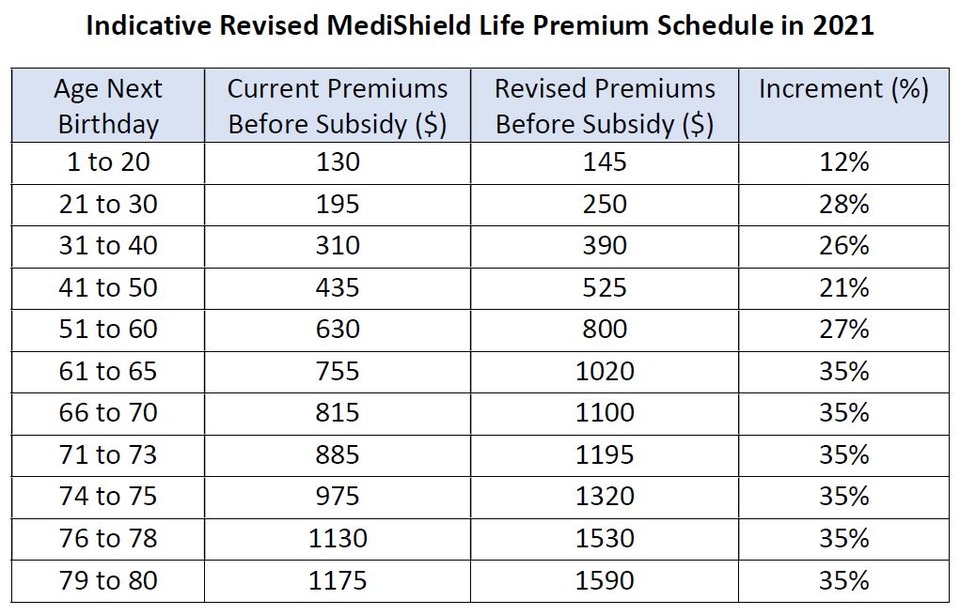

MediShield Life payouts have been increasing in the recent years. Also taking into consideration the enhancements above, the MediShield Life Council recommends adjusting the premiums as proposed by the actuary to ensure that the scheme continues to be sustainable. The proposed increase in MediShield Life premium ranges from 12% to 35% according to different age groups. The indicative revised MediShield Life premium schedule for people up to 80 years old is illustrated as follows:

Source of Information: Ministry of Health, Singapore

The revised premium can still be fully paid by CPF Medisave Account. Meanwhile, the government will also have premium subsidy schemes for senior citizens and lower income families.

The adjustments introduced in this article is still under public consultation. When the adjustments are confirmed, I will write another article to share more details. If you have any relevant questions, welcome contacting me for a discussion.

Tony

Tony

October 19, 2020

October 19, 2020