Understand the Return of Singapore Savings Bonds

Singapore Savings Bonds is a low risk (almost risk-free) investment vehicle provided by the Singapore Government. Recently my clients and friends told me that the return structure of Singapore Savings Bonds is not easy to understand. So I have an introduction in this article.

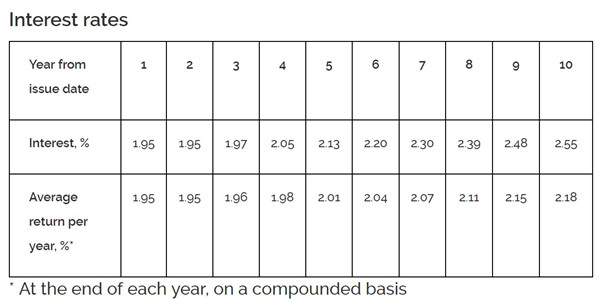

Singapore Savings Bonds is issued every month to investors. Before its issuance, the interest rate table can be found on its official website. The interest table for the Singapore Savings Bonds which will be issued in Mar 2019 is copied as follows:

Table 1

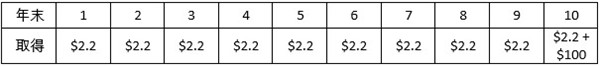

Looking at this table, people who are not familiar with bond structure will feel very confused. To make it clear, I need to introduce the classic bond structure. The classic bond structure is: when the investor invests $100 principal, the borrower will indicate a coupon rate (e.g. 2.2%) and a tenure (e.g. 10 years). According to this example, the return table for the investor is as follows:

Table 2

The investor receives interest (coupon) at end of every year. (Most classic bonds pay coupons semi-annually at half of the coupon rate. But here we illustrate as annual coupon payment for easy understanding.) The interest is determined by the product of the principal $100 and the coupon rate 2.2%. Since the interest is fixed, this investment vehicle is categorised as “fixed income”. At end of the tenure, the investor will receive the principal $100 besides the interest $2.2.

Then you may ask, why the interest rates for Singapore Savings Bonds (refer to the second row Interest in Table 1) are not the same for each year?

This is because, in the classic bond structure, the tenure of a bond is fixed. The coupon rate varies when the tenure changes. This is similar as fixed deposits with a bank. Let’s go back to the classic bond example. The coupon rate for a tenure of 10 years is 2.2%, while the coupon rate for a tenure of 5 years may be 1.6%. Once an investor purchases a bond, he or she has to wait till the end of the tenure to get back the principal. On the other hand, for Singapore Savings Bond, although there is a tenure of 10 years, the investor can take back the principal any time during the 10-year tenure. To make sure the market is fair and there is no arbitrage, Singapore Government has to set a different coupon rate in different year for Singapore Savings Bonds, so if Investor A purchases Singapore Savings Bonds and takes back the principal during the tenure (e.g. at end of the 5th year), his or her principal and interests received within these 5 years has to be equivalent with the principal and interests received by Investor B who purchases a 5-year Singapore Government Security (which is in a classic bond structure). As for how to make them “equivalent”, there are a few mathematics calculations. I don’t want to bore you here.

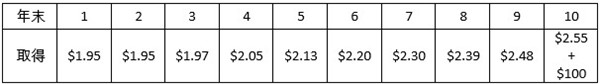

In short, because Singapore Savings Bonds do not have a “fixed” tenure, the coupon rate is not the same for each year. According to Table 1, we can derive the return table for a Singapore Savings Bond investor who invests $100 (kindly note that the actual minimum purchase amount is $500 while here we use $100 for simple illustration) as follows:

Table 3

Then you may ask another question: what are the numbers in the third row of Table 1 (Average return per year)?

From Table 3 we can see, that the interests paid by Singapore Savings Bonds are simple interest instead of compound interest. That is to say, the investor has no option to re-invest the interests to the same Singapore Saving Bond. This return structure makes it difficult to compare the return of Singapore Savings Bonds with other investment vehicles in the market. Therefore, numbers in the third row of Table 1 (Average return per year) are translated compound interest rates assuming the investor redeem the principal at end of a specific year. But how does this “translation” work? Assuming Singapore Savings Bonds is a money generating machine. The investor input $100 into the machine. At end of Year 1, the machine generates $1.95. At end of Year 2, the machine generates $1,95. … At end of Year 5, the machine generates $2.13. At that time the investor stops the machine and takes back the $100 principal. Let’s say any money inside the machine has an identical annual return of R. And at the end of each year, after generating the interest to the investor, all the money in the machine will continue to grow at rate R. After calculation, we get R as 2.01%, the number at the column of Year 5 in the third row of Table 1.

Now you know the return mechanism of Singapore Savings Bonds. But what are the differences between Singapore Savings Bonds and other low risk investment vehicles in Singapore? Let’s discuss in the next article.

P.S. I’m Tony, Your one stop trustworthy financial service provider. Find Out More …

Tony

Tony

February 14, 2019

February 14, 2019