Calculate Your Regular Expenses - The First Step of Financial Planning

Financial planning is a type of personalized service. The data input by a client during the planning is usually highly relevant to the client’s daily living. The accuracy of the input will directly impact the validity of the planning. Personal regular expenses is one kind of such data. It is so important that it affects the calculation of various of essential indicators. This article uses a simple case study to illustrate how to calculate regular expenses for a person.

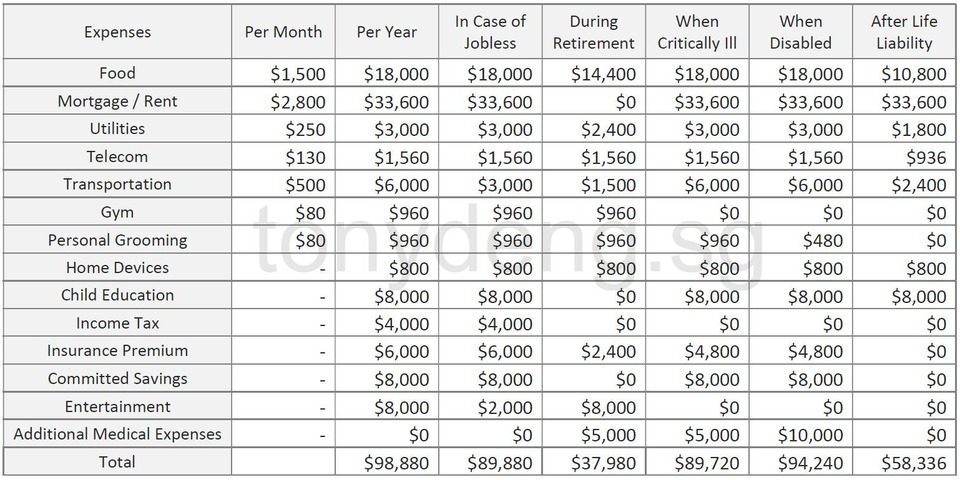

In this case study, Mr Tan is married with one child. Mrs Tan is a full-time housewife. Mr Tan is the sole breadwinner of the family. The calculation of Mr Tan’s regular expenses is shown in the table below.

The first column of the table is a list of Mr Tan’s daily expenses. For the convenience of illustration, we list the monthly expenses (from “Food” to “Personal Grooming”) first, and then followed by expenses that do not regularly incur every month (from “Home Devices” to “Entertainment”). The last item “Additional Medical Expenses” only happens in specific scenarios, which will be elaborated later. The second and third columns are the monthly and yearly expenses respectively. What we need in the end is yearly expenses, so monthly expenses are supporting values. We get yearly expenses by multiplying monthly expenses by 12. After summing up all the yearly expenses, we get Mr Tan’s total yearly regular expenses $98,880. From “In Case of Jobless” to “After Life Liability” are indicators derived from Mr Tan’s yearly expenses. When calculating these indicators, Mr Tan needs to consider under the specific scenario, how each expense item varies from the value in “Per Year” column, and make adjustments accordingly. Each indicator is elaborated as follows.

Indicator 1: In Case of Jobless

This indicator is used for calculating Mr Tan’s emergency reserve fund. A healthy financial plan shall include emergency reserve fund that covers about 6 months of daily expenses, in case of sudden loss of job. In Mr Tan’s opinion, if he were jobless, his transportation expense would reduce to 50% of the original value and entertainment expense would reduce to 25% of the original value. All other expenses would remain the same. After such adjustment, we get the values under “In Case of Jobless” column. The total amount of yearly expenses is $89,880. To cover 6 months of daily expenses, Mr Tan needs $44,940 of emergency reserve fund.

Indicator 2: During Retirement

This indicator represents the annual expenses for a person after retirement. For Mr Tan, all the expenses related to his child reduce to zero when he retires. The home loan should be paid off, so there is no mortgage expense. Since he is no longer working, transportation expense reduces. There is no more taxable income, so income tax drops to zero. As for insurance, he would only keep hospitalisation insurance and long-term care insurance. Committed savings are not required at that time. But because of old age, there may be some additional medical expenses. The total amount $37,980 under this column is the basic for Mr Tan’s retirement planning.

Indicator 3: When Critically Ill

This indicator represents the annual expenses for a person when he or she is diagnosed with critical illness and needs to stop working and receive treatment. In Mr Tan’s opinion, his first four daily expenses would not change in this scenario. Although his transportation expense would reduce because he is no longer working, he may need to visit hospital frequently, which would increase the transportation expense back to the original level. At that point he would not be able to go to gym, so this expense reduces to zero. He would stop working so income tax drops to zero as well. Some insurance policies waive the premiums when he is critically ill. To focus on recovery, he would also avoid entertainments. But there should be certain additional medical expenses. The total amount $89,720 under this column is the basic to calculate the necessary sum assured for Mr Tan’s critical illness insurance.

Indicator 4: When Disabled

This indicator represents the annual expenses for a person who is disabled unfortunately. Mr Tan’s estimation for this column is mostly similar as that in the “When Critically Ill” column, except that there would be less expense on personal grooming, while additional medical expenses would double. The total amount $94,240 under this column is the basic to calculate the necessary sum assured for Mr Tan’s disability insurance.

Indicator 5: After Life Liability

This indicator represents the annual liability to a person’s dependents when he or she passes away unfortunately. In this scenario, all expenses related to Mr Tan himself drops to zero, only left with the expenses for his wife and child. The total amount $58,336 under this column is the basic to calculate the necessary sum assured for Mr Tan’s life insurance.

The case study above tells us that the calculation of regular expenses is important for personal financial planning. The list of expenses may be similar among different people, but the details will not be exactly the same. Under various scenarios (jobless, retired, critically ill, disabled, dead), different people may have different estimation on expenses adjustments. Moreover, in different life stage of the same person, the items and values in the table will change gradually. As a result, in order to optimize one’s financial plan, a person should work with a professional financial planner to create and fill up his or her regular expenses table. This table should also be updated every year during the annual financial planning review. If you have any inquiries about this topic, welcome contacting me for further discussion.

Tony

Tony

May 18, 2020

May 18, 2020