A Comparison among the Low Risk Investment Vehicles in Singapore

In last article, I had an introduction of the return mechanism of Singapore Savings Bonds. Singapore Savings Bonds is a low risk (almost risk free) investment vehicle. So what are the common low risk investment vehicles in Singapore? What are the differences among these investment vehicles? We will answer these questions in this article.

At first, the common low risk investment vehicles in Singapore for normal investors include fixed deposits with a bank, Singapore Savings Bonds, CPF Ordinary Account, CPF Special Account, and endowment plans with an insurance company.

Fixed deposits with a bank should be the most widely known vehicle. In Singapore, currently the fixed deposit tenure with major banks ranges from 1 month to 60 months. The annual interest rate ranges from 0.05% to 1.40% correspondently. Some banks with small market share may have promotion for fixed deposit interest rates in order to expand their market share. Under such promotions, a 12-month fixed deposit would offer an annual interest rate ranging from 1.70% to 2.00%. The promotions change from time to time, and there is normally a minimum deposit amount. The principal of a fixed deposit has high liquidity, because when there is an emergency withdrawal before maturity, there is no loss on principal but only lower interest amount.

The tenure for Singapore Savings Bonds is 10 years. However, there is no penalty withdrawing the bond before maturity. So its actual tenure is 1 month to 10 years. Based on different actual tenure, currently the annualised compound interest rate ranges from 1.95% to 2.18%.

The current interest rate of CPF Ordinary Account is 2.50% per annum (the first $60,000 of combined balance in the three CPF accounts enjoys additional 1.00% annual interest rate, but for Ordinary Account it caps at $20,000). The investment horizon is at least till the person's age 55 (at age 55, the person has to save a mandatory amount into the CPF Retirement Account before the balance of the CPF Ordinary Account can be withdrawn). There are designated ways of using the money in this account. The main ways are for housing and instalment, while other ways include education and other investments. The balance in this account has no liquidity other than the designated ways of use. But the person can enjoy tax relief by contributing to this account.

The current interest rate of CPF Special Account is 4.00% per annum (the first $60,000 of combined balance in the three CPF accounts enjoys additional 1.00% annual interest rate). The investment horizon is at least till the person's age 55 (at age 55, the person has to save a mandatory amount into the CPF Retirement Account before the balance of the CPF Special Account can be withdrawn). The money in this account is mainly used for retirement. The balance in this account has no liquidity other than this designated way of use. But the person can enjoy tax relief by contributing to this account.

The investment horizon for endowment plans ranges from 5 years to 25 years. To better compare with the four investment vehicles above, here we only discuss the category of endowment plans where the insurance company's guaranteed payout is more than what you put in. The return for this type of endowment plans is partially guaranteed. The non-guaranteed part return is subjected to the low-risk investment return from the insurance company. Currently, according to different investment horizons, the annual return for such endowment plans ranges from 2.00% to 4.00%. To achieve better return, this investment vehicle doesn't encourage withdrawal before maturity. So the liquidity is low.

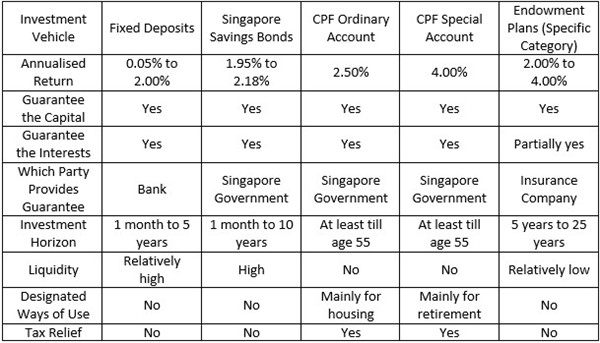

The table below illustrates the differences among these five low risk investment vehicles in Singapore:

Note: This table is updated as of Feb 2019.

This article is only a brief introduction. Welcome contacting me for a detailed discussion if you have any questions regarding this topic.

P.S. I’m Tony, Your one stop trustworthy financial service provider. Find Out More …

Tony

Tony

February 19, 2019

February 19, 2019